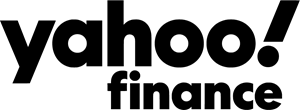

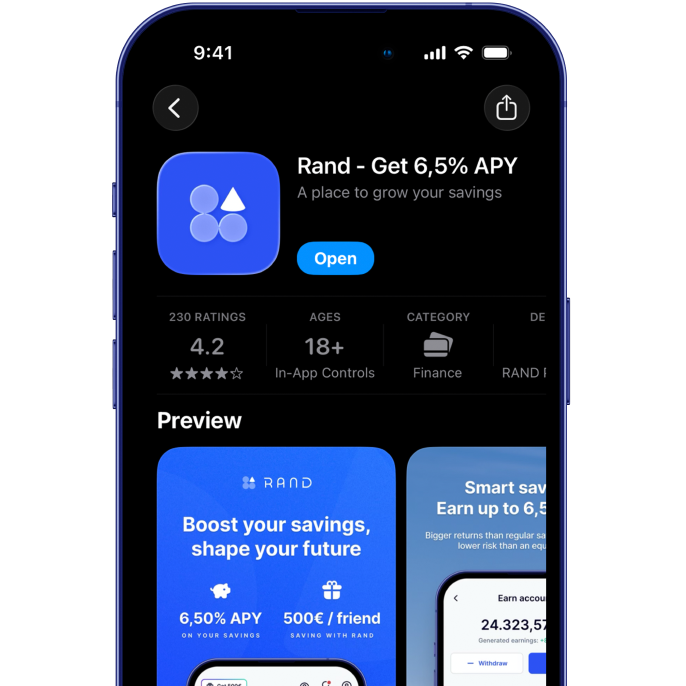

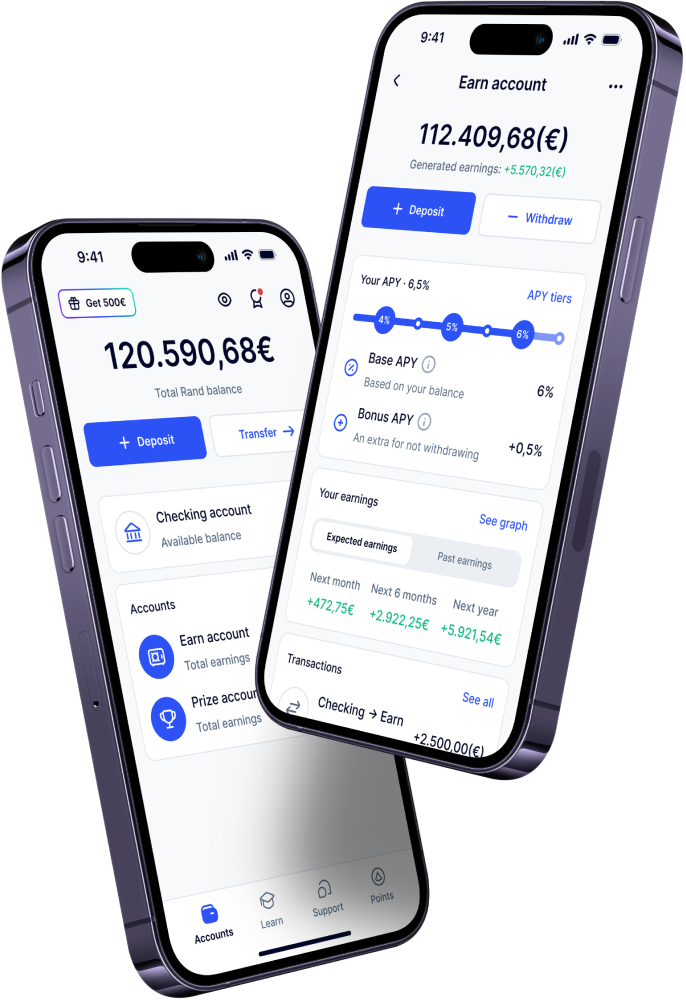

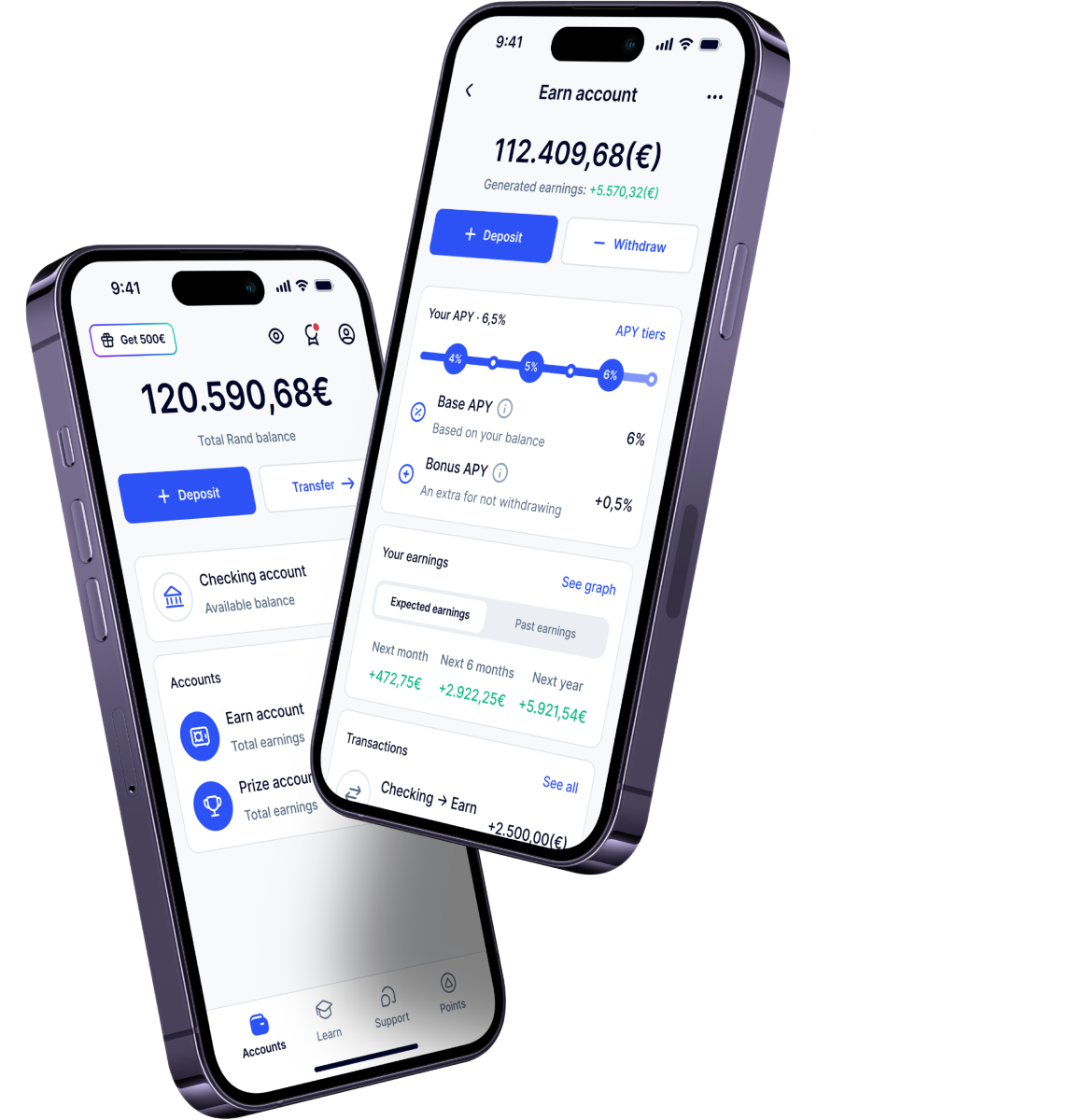

Earn up to 6,50% on your savings

Grow your balance daily with industry-leading interest

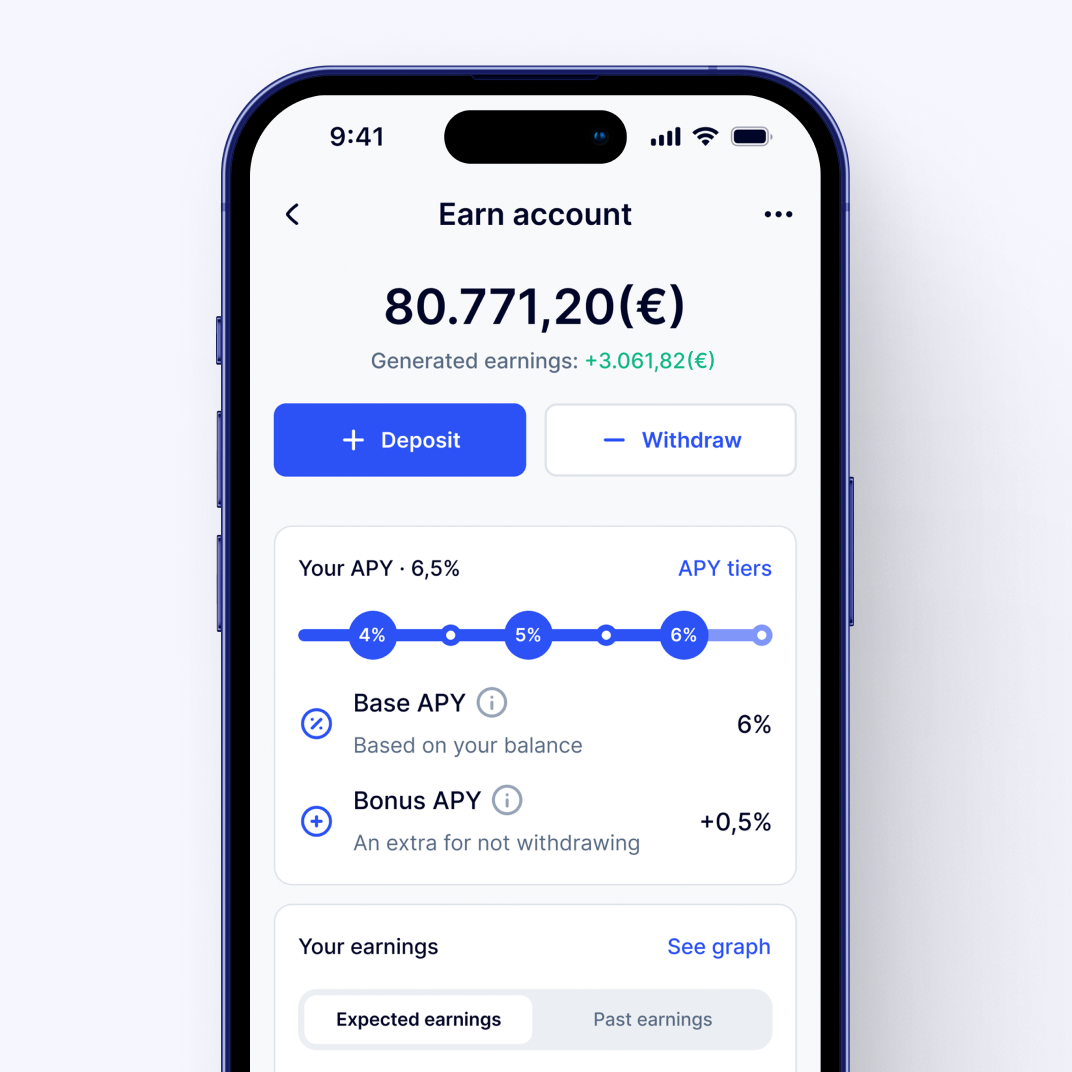

Grow your balance daily with industry-leading interest and the highest standards of security.

Rand is a financial technology company, not a bank. Banking services are provided by PecunPay Cards. See your applicable agreement here.